스포트라이트

Analyst, Credit Products Officer, Equity Research Analyst, Financial Analyst, Investment Analyst, Planning Analyst, Portfolio Manager, Real Estate Analyst, Securities Analyst, Trust Officer

They say it takes money to make money and investing is the most common way of doing that. From stocks and bonds to real estate and cryptocurrencies, investing is one of the most tried-and-true methods of earning profits over the long run. However, it’s also inherently risky since markets fluctuate all the time due to factors impacting companies and the economy as a whole. There are zero guarantees of reaping a return on investment, and it’s entirely possible to lose all your money.

That’s why savvy investors turn to Financial Analysts who can advise them on strategies that are right for their budget, goals, risk tolerance, and timelines. Financial Analysts study how stocks, real estate, and other investment types are doing, then try to predict future performance. Because there are so many human elements in the equation, such analysis is as much an art as it is a science.

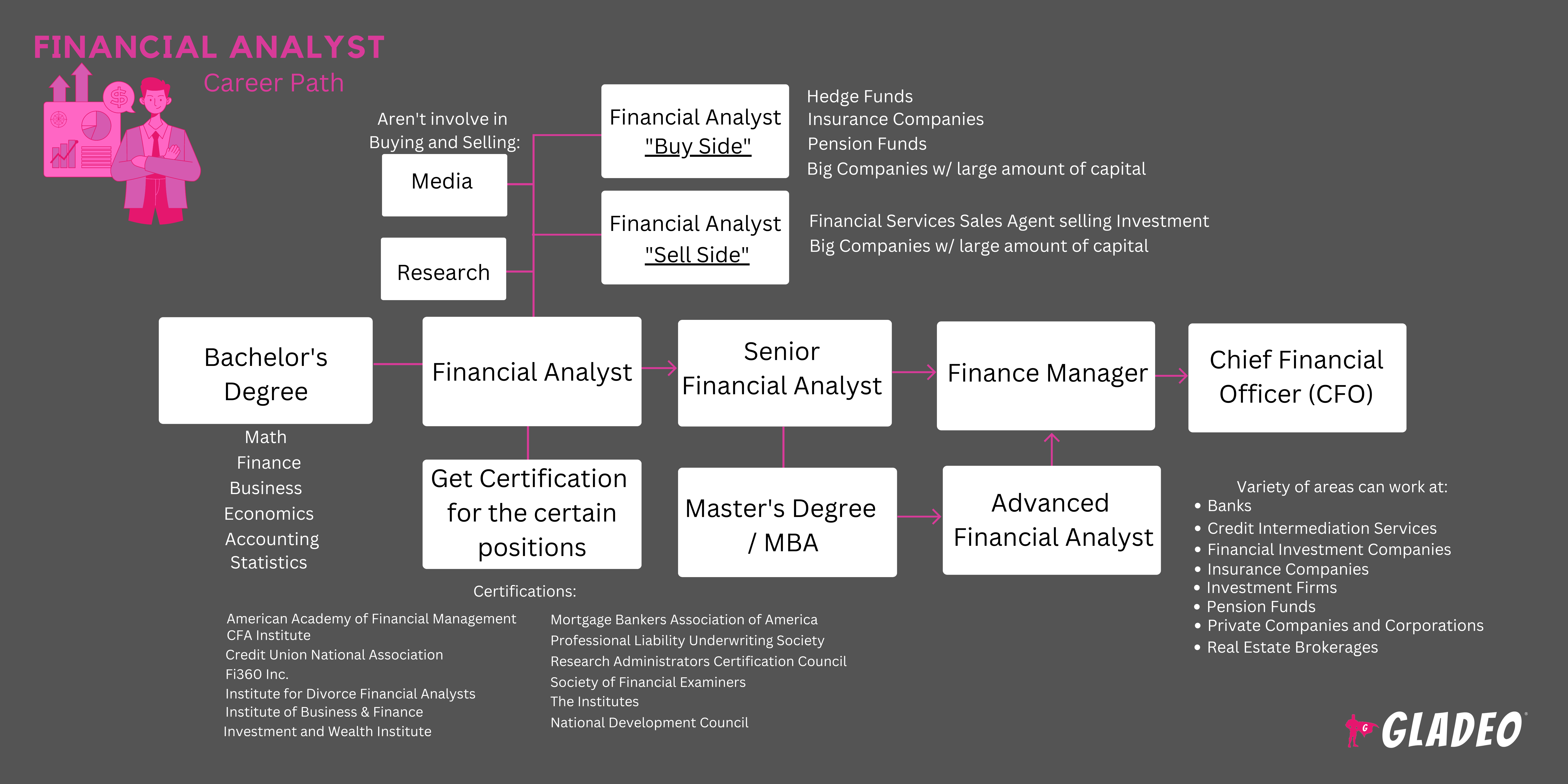

Generally speaking, Financial Analysts focus on either the “buy-side” (for hedge funds, insurance companies, pension funds, and big companies with large amounts of capital to invest) or the “sell-side” (for financial services sales agents selling investment options). Some work strictly for media and research employers who aren’t involved in buying or selling. They may specialize in particular regions, industries, or products.

Financial Analysis is a broad career field to break into! The term Financial Analyst encompasses financial risk specialists, fund and portfolio managers, investment analysts, ratings analysts, and securities analysts. Each role varies in duties and scope of responsibility, but they’re all tied to the dynamic field of financial analysis.

- Helping employers earn profits used to benefit companies or individuals

- Being part of the world of investing, which has economic impacts on every person on Earth

- Learning how equities (stocks), bonds, real assets (real estate, commodities like gold, oil), and cryptos function as investments

근무 일정

Financial Analysts work typical day schedules, with overtime or evening work necessary depending on client needs. Work is usually indoors, with some travel needed from time to time.

일반적인 의무

- Review client financials (income statements, balance sheets, cash flow) to assess their capital needs, investment budgets, and risk tolerance

- Consider investment types and portfolios to recommend to clients

- Suggest investment remedies, debt restructuring, refinancing, and other fixes to an employer’s financial problems

- Prepare reports and presentation materials with explanatory graphics to help clients understand options

- Study companies whose stocks might be potentially good investments. Conduct site visits, as needed

- Evaluate historical real estate sales data to forecast if a property is a viable investment

- Utilize financial models and programs to aid with developing investment strategies

- Pay attention to local, national, and global economic and business trends

- Prepare and execute approved action plans for financial investments, transactions, and deals

- Work with investment bankers, accountants, PR staff, attorneys, and other relevant parties

- Evaluate existing investment performance and recommend adjustments or sales

- Seek out new opportunities to diversify, boost potential profits, and mitigate risk

- Compare securities in various industries

- Analyze data regarding prices, yields, and stability

- Collaborate as needed with governmental agencies. Ensure compliance with regulations and laws

- Help clients understand tax implications of investments

추가 책임

- Stay up-to-date by reading financial publications

- Find “green” investment opportunities

- 필요에 따라 새로운 고객을 유치하기 위해 서비스를 광고합니다.

- Train and mentor new analysts

소프트 스킬

- 능동적 인 듣기

- 적응성

- 분석

- 규정 준수 지향

- 비판적 사고

- 디테일 지향

- 징계

- 재정적 통찰력

- 끈기

- 고집

- 설득

- 계획 및 구성

- 문제 해결 능력

- 회의론

- 건전한 판단

- 강력한 의사 소통 기술

- 팀워크

- 시간 관리

기술 능력

- Math and accounting skills

- Strong understanding of economics and investments

- Familiarity with applicable laws governing the securities industry, such as:

- Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010

- Investment Advisers Act of 1940

- Investment Company Act of 1940

- Jumpstart Our Business Startups Act of 2012

- Sarbanes-Oxley Act of 2002

- Securities Act of 1933

- Securities Exchange Act of 1934

- Trust Indenture Act of 1939

- Analytical software such as SAS, MATLAB, Spotfire, QlikView, Tableau, and MicroStrategy

- Other digital tools including Excel, SQL, VBA, Python, and R

- 은행

- Credit intermediation services

- Financial investment companies

- 보험 회사

- Pension funds

- 민간 기업 및 기업

- Real estate brokerages

Investors rely heavily on the expertise of their Financial Analyst teams. Sound investments can equal long-term profitability and stability, which often translates to ongoing work for a company’s employees. Bad investments might cause a business to suffer significant financial losses, leading to downsizing, worker layoffs, or even bankruptcy.

Expectations run high and Financial Analysts must work hard to conduct thorough research and create accurate models to forecast the best investments for their clients’ needs. As Zippia points out, “while financial analysts are usually paid well, it comes at the cost of a healthy work-life balance in many cases.” Potentially long hours and the stress from so much pressure causes some analysts to experience burnout.

The economy has been seeing turbulent times, with investors riding a rollercoaster as stocks, mutual funds, ETFs, real estate, and crypto prices have fluctuated in unpredictable ways. Such volatility is the opposite of what most Financial Analysts want to see when it comes to wealth building, yet there haven’t been many safe harbors lately. There are relatively safe options such as savings accounts, bonds, treasury bills, and similar items, but the return on such low-risk investments may not even keep up with inflation. Meanwhile, some analysts do suggest taking advantage of lowered stock prices, advocating a “buy the dip” strategy while stocks are “on sale.”

The digitalization of currency has become a growing trend, with plenty of investors viewing cryptocurrencies and NFTs (non-fungible tokens) as an intriguing alternative to traditional investment vehicles. Indeed, venture capitalists alone sank over $33 billion in crypto and blockchain in 2021. Meanwhile, trading apps have utterly revolutionized how everyday people trade, which in turn impacts the overall market greatly.

Financial Analysts may have always enjoyed learning about money, how it works, and how it can be used to make even more money! Growing up, they might have been entrepreneurs who launched their own side hustles online or in-person. They could have enjoyed playing around with stocks and cryptos, trading via mobile apps and engaging in online forums. It’s possible they liked math, finance, economics, and programming classes in school. Others might have come to them for help or advice about investments, leading them to realize they could turn their skills into a well-paid profession one day!

- Entry-level Financial Analyst jobs require at least a bachelor’s degree in economics, finance, business, math, or a related major

- Large employers may want analysts with a master’s, such as an MBA

- Some analyst roles require an understanding of physics, applied math, and engineering principles

- There are many certifications available which can help qualify you for certain positions. These include:

- American Academy of Financial Management - Accredited Financial Analyst

- CFA Institute - Chartered Financial Analyst

- Credit Union National Association - Certified Credit Union Investments Professional

- Fi360 Inc. - Accredited Investment Fiduciary

- Institute for Divorce Financial Analysts - Certified Divorce Financial Analyst

- Institute of Business & Finance -

• Certified Income Specialist

• Certified Funds Specialist

- Investment and Wealth Institute - Certified Investment Management Analyst

- Mortgage Bankers Association of America - Certified Residential Underwriter

- Professional Liability Underwriting Society - Registered Professional Liability Underwriter

- Research Administrators Certification Council - Certified Financial Research Administrator

- Society of Financial Examiners -

• Certified Financial Examiner - Financial Analyst

• Accredited Financial Examiner - Financial Analyst

- The Institutes - Associate in Commercial Underwriting

- National Development Council - Economic Development Finance Professional

- Financial Analysts who sell products need a license through the Financial Industry Regulatory Authority (FINRA). Licensures are typically obtained after an analyst starts working

- Try to decide early on if you plan to pursue a master’s or not. It may be easier to complete both your bachelor’s and master’s at the same school

- 수업료, 할인 및 지역 장학금 기회 비용을 고려하십시오 (연방 지원 이외에)

- 캠퍼스, 온라인 또는 하이브리드 프로그램에 등록할지 여부를 결정할 때 일정과 유연성에 대해 생각해보십시오.

- 프로그램의 교수진 상과 업적을 확인하여 그들이 무엇을 했는지 확인하십시오.

- 취업 알선 통계 및 프로그램의 동문 네트워크에 대한 세부 정보를 검토하십시오.

- 회계 또는 재무 분야 아르바이트 지원 고려하기

- 수학, 금융, 경제, 통계, 비즈니스, 물리학, 컴퓨터 과학/프로그래밍 수업에서 열심히 공부하세요.

- 돈을 관리하고 실용적인 소프트 스킬을 배울 수 있는 학생 활동 자원봉사에 참여하세요.

- Learn about the various types of Financial Analyst roles, such as financial risk specialists, fund and portfolio managers, investment analysts, ratings analysts, and securities analysts

- Review job postings in advance to see what the average requirements are. If you know which company or employer you want to work for, ask to schedule an informational interview with one of their working analysts to learn more about their jobs and their clients’ needs

- 대학에서 인턴십과 협력 경험을 찾아보세요.

- 향후 취업 참고자료가 될 수 있는 사람들의 이름과 연락처 정보를 추적하세요.

- Study books, articles, and video tutorials related to different types of investing. Participate in online discussion groups that are realistic and grounded in actual analysis

- Consider if you want to specialize in a particular region, industry, or investment type so you can tailor your education accordingly

- 전문 조직과 협력하여 배우고, 공유하고, 친구를 사귀고, 네트워크를 성장시키십시오(리소스 > 웹사이트 목록 참조).

- Knock out any relevant certifications as soon as you can to bolster credentials and make you more competitive in the job market

- 이력서 초안 작성을 일찍 시작하고 진행하면서 계속 추가하여 아무 것도 놓치지 않도록 하십시오.

- 가능하면 지원 전에 실무 경험을 쌓아두세요. 재무, 회계, 비즈니스 관련 직무가 지원서에 잘 어울립니다.

- 이 분야에서 일을 시작하는 데 석사 학위가 필요하지는 않지만, 대학원 학위가 있으면 경쟁에서 앞서 나갈 수 있습니다.

- Let your network know you are looking for work. Most job opportunities are actually discovered through personal connections

- 인디드, 심플리 하이어드, 글래스도어와 같은 취업 포털과 입사하고 싶은 회사의 채용 페이지를 확인하세요.

- 광고를 신중하게 선별하고 자격을 갖춘 경우에만 신청하십시오.

- 금융 관련 견습직이나 협동조합 경험은 취업에 도움이 될 수 있습니다. 이력서에 멋지게 보일 뿐만 아니라 나중에 개인적인 추천서를 얻을 수도 있습니다.

- Reach out to working Financial Analysts to ask for job-seeking tips

- Move to where the most job opportunities are! The states with the highest employment level for Financial Analysts are New York, California, Texas, Illinois, and Florida

- 많은 대기업이 지역 프로그램에서 졸업생을 모집하므로 대학의 프로그램이나 직업 센터에 채용 담당자 및 취업 박람회와 연결하는 데 도움을 요청하십시오.

- 커리어 센터에서는 이력서 작성과 모의 면접에 대한 지원도 제공합니다!

- 전직 교사와 감독자에게 개인적인 추천인이 될 것인지 미리 물어보십시오. 허락 없이 연락처 정보를 나열하여 방심하지 마십시오.

- Quora에 계정을 만들어 현업 종사자에게 직무 조언을 구하세요.

- Check out Financial Analyst resume templates to get ideas

- 모든 고용주에게 동일한 이력서를 보내는 대신 지원하는 직업에 맞게 이력서를 조정하십시오.

- List all education, skills, training, and work history on your resume, including stats on return on investments (if applicable)

- 전문 이력서 작성자 또는 편집자가 이력서 초안을 작성하거나 검토하는 것을 고려하십시오.

- Financial Analyst interview questions to prepare for those interviews

- 면접 성공을 위한 적절한 복장!

- Consistently earn your employers/clients a strong return on investment and build them portfolios that can weather economic storms

- Work extra hours as needed, to ensure you’re doing your best for those who’ve entrusted you with their funds

- Take your responsibilities for handling other people’s money seriously

- Understand and comply with all legal and ethical requirements

- Utilize the most up-to-date programs and techniques to maximize returns

- Learn as much as you can about the various aspects of financial analysis, while also specializing in your chosen field

- Expect to start out in entry-level roles then work your way up to positions of greater responsibility, such as portfolio manager or fund manager

- Get your FINRA license as soon as you are able, and obtain advanced certificates when you have enough work experience

- One of the most common cers is the Chartered Financial Analyst credential offered by the CFA Institute

- If you don’t already have a master’s, consider doing an MBA program at night while working

- Let your manager know when you’re ready to tackle more or larger projects

- Collaborate effectively on teams, stay level-headed and focused, and demonstrate leadership when opportunities arise

- 전문 조직에 참여하여 네트워크 성장

웹사이트

- American Academy of Financial Management

- 금융 전문가 협회

- CFA 연구소

- Credit Union National Association

- Fi360 Inc.

- 금융 산업 규제 당국

- 글로벌 재무 및 경영 아카데미

- Institute for Divorce Financial Analysts

- Institute of Business & Finance

- Investment and Wealth Institute

- 미국 모기지 뱅커 협회

- National Development Council

- Professional Liability Underwriting Society

- Research Administrators Certification Council

- Society of Financial Examiners

- 교육 기관

책

- Fundamental Analysis for Beginners: Grow Your Investment Portfolio Like A Pro Using Financial Statements and Ratios of Any Business with Zero Investing Experience Required, by A.Z Penn

- Investing 101: From Stocks and Bonds to ETFs and IPOs, an Essential Primer on Building a Profitable Portfolio, by Michele Cagan CPA

- Technical Analysis of the Financial Markets: A Comprehensive Guide to Trading Methods and Applications, by John J. Murph

- The Essentials of Financial Analysis, by Samuel Weaver

Working as a Financial Analyst can be stressful at times, especially when the economy is rocky and it is tougher to earn good return on investments. Oftentimes, analysts get blamed for results based on factors far beyond their control. A few related occupations to consider, per the Bureau of Labor Statistics, include:

- 예산 분석가

- 재무 관리자

- 보험 언더라이터

- 개인 재무 설계사

- 증권, 상품 및 금융 서비스 판매 대리점

In addition, O*Net Online lists the below-related fields:

- Credit Analyst

- 재무 리스크 전문가

- Investment Fund Manager

뉴스 피드

주요 채용 정보

온라인 과정 및 도구

연봉 기대치

New workers start around $79K. Median pay is $94K per year. Highly experienced workers can earn around $114K.

연봉 기대치

New workers start around $107K. Median pay is $132K per year. Highly experienced workers can earn around $170K.

연봉 기대치

New workers start around $92K. Median pay is $115K per year. Highly experienced workers can earn around $133K.

연봉 기대치

New workers start around $93K. Median pay is $119K per year. Highly experienced workers can earn around $182K.

연봉 기대치

New workers start around $85K. Median pay is $104K per year. Highly experienced workers can earn around $124K.